March 2020 will be a memorable date in the US bond calendar The value of bonds traded on the capital markets is much bigger than the equities market and the sudden movement of bond prices creates a tsunami-like threat for any country’s business cycle and the lives of those in its path and so it is important to understand the nature and role of bonds. We saw such a wave in the first two weeks of March 2020, first from the COVID 19 pandemic and then the collapse of the oil price caused by the standoff between Saudia Arabia and Russia

The relationship between the price of a bond and prevailing interest rates

Consider a two year 10% Treasury note issued by the US government. The £100 is known as the face value of the note and the interest rate attached to the note is known as the coupon rate. The government will pay £10 semi-annually for two years, and £100 at the end of the two-year term. Assume, also that other similar securities are providing a return of 10%. if one does the maths and were to discount back each of these cash flows, we would find that the price of the bond will be equal to £100. In other words, if the prevailing interest rate (yield) is equal to the coupon rate, the price of the bond or fair value will equal the face value and is said to be priced at par. Another way to think of this is to imagine that the price of a bond today is made of a bundle of investments, each of which will grow at the prevailing interest rate to the value of the future coupons and the final principal. So, what would happen to the price of the bond if the prevailing interest rate was 12% i.e higher than the coupon rate of 10%? Well now, because each investment in the bundle grows at 12% instead of 10%, the value of the total bundle of investments or the bond price today should be less than £100. It will be around £96. The bond price is, therefore, inversely related to the bond’s –yield. Bond, notes, and bills are just different terminologies for US Treasury IOU’s that have different maturity dates. Bonds are long-dated notes of 10 years or more, bills are for up to a year and notes fit snugly in between.

How is the bond price effected by stock prices?

If there is a buoyant stock market, new bond issuers are forced to offer higher returns or yields to attract equity investors away from the stock market which would mean that existing bond prices would get cheaper and the converse is true in an economic downturn. So, we can say that yields usually follow the business’ stock cycles woes.

How does the budget deficit affect bond prices?

The US has been experiencing deficits almost every year since the ’60s though, notably there were four consecutive years of surplus during Clinton’s tenure between 1998 and 2001 coinciding with peak employment levels. In times of deficit, the government borrows through institutional bond issues and the yields ought to be higher because of demand and this should, in turn, make existing bonds cheaper. The IMF published a working paper in August 2010 examining the relationship between so vereign debt yields and fiscal deficits and levels of government debt and the study revealed that higher levels of debt led to increases in interest rates. However, in the case of the USA, we find this is not true as even though US debt has doubled during the last decade to $24tn, from 125% of GDP to 135%, the yields on 10 year Treasuries fell from 3% to 0.6%. There was some positive correlation between debt levels and yields between 2016 and 2018 but after 2018, when debt levels kept climbing, yields kept falling. The direction and level of yields tell us that the bond market is not confident about the long term economic outlook for the US and was already expecting some sort of recession before COVID 19.

Monopoly money and should everyone be equally rewarded?

It is also interesting to note that 10-year yields fell sharply when the Fed decided to increase its balance sheet in 2008 in the hope of providing liquidity to the commercial banks and dealers in commercial paper. I like to call this ‘monopoly’ money after the famous board game. The game was designed by Elizabeth Magie, who was born in Illinois after the end of the US Civil War, in protest against the big monopolists like Rockefeller and Carnegie of her time. What most people don’t know was that there were two rules to the game, the monopolistic and the anti-monopolistic rules but today everyone has forgotten about the latter. Unlike the former, the anti-monopolistic rules made sure that everyone was equally rewarded when wealth was created.

Horses and Hounds

Ten-year Treasury yields have been gradually falling since their highs of 1980 when they stood at 14%. Had an investor purchased 10year 14% zero-coupon Treasury strips, they would have achieved a return, with little risk, close to the performance of the S&P 500 which grew uninterrupted 8.5% year on year. The S&P continued to soar, levelling out in 2000 by which time the Treasury was still showing a handsome 8%. The comparison of the performance between bonds and stocks can be likened to a comparison between a relay of horses (representing the bonds) and hounds (representing the equities) racing each other against the clock through thickets and forest. The hound is agile and faster but his natural advantage also makes him more prone to falling and susceptible to obstacles and undulations of the ground but the horses, though slower, are steadier, unless they hit a tree!

Airlines are a barometer of the US economy

Bond values are affected by several factors such as relative maturities, credit quality, and structure such as convertibility and call protection, and convexity which is the sensitivity of price to changes in interest rates. The Dallas based Southwest Airlines is the largest budget airline in the USA by passenger size and third-largest by fleet. Its stock price tanked from $50 to $29 because of the corona pandemic which prematurely pricked the now-familiar credit bubble. For the past thirty years, the airline has been consistently profitable reporting a whopping $400M of net income every quarter but in Q1 of 2020, its net income immediately fell into the red. The company cut its stock by half and has a grim outlook. Even still, it has managed to raise $4bn through the sale of shares and 1.25% 2025 convertible loan notes at a conversion price of $38. The normal loan notes with the same maturity have a coupon of 5.25%. Southwest is fortunate in that it had accumulated a war chest of cash on its balance sheet but acknowledges this will be depleted quickly even after stripping back expenditure. It is expecting to fill just 9% of its fleet and cannot predict the point of profitability This large budget airline is a good barometer to the US economy because transportation is the nervous system of the economy integral to work and businesses.

Vigilantes on horsebacks are a thing of the past?

The US bond market is worth around $40tn and is almost half the size of the global total and a third bigger than its sister US equities market. The major share of the US bonds is taken up almost equally by the treasury, corporate, and mortgage debt which together makes up three-quarters of the total with municipal debt (10%) and short-term money market (3%) trailing behind. The economist Yardeni coined the phrase ‘bond vigilantes’ eliciting an image of saddled cowboys taking the law into their own hands. The bond vigilantes managed to push back against Clinton’s fiscal spending agenda by selling off their holdings driving up yields. Dr. Alan Greenspan agreed that the cowboys had a hold over the Treasury but that argument is now defunct as we are witnessing all-time low yields in long periods of fiscal deficits.

Municipal and corporate bonds

A lot of portfolio management takes place at the level of corporate bonds also known as the ‘taxable sector’ where large volumes are traded electronically from screens by a few big players. Bonds on the tax-free side, or municipal bonds, (‘muni bonds’) are much smaller in size and less liquid and move at the pace of an over the counter market. Bonds can be owned directly or held through mutual funds or exchange-traded funds (ETF’s) which provide a single price for a bunch of funds they invest in. Whatever the case, each security each is identified by a special number called the CUSIP code, a North American securities identification system. Owning individual bonds provides more flexibility particularly at times of volatility when holders rush to liquidate their positions to get hold of cash.

Effect of oil price on equities and bonds

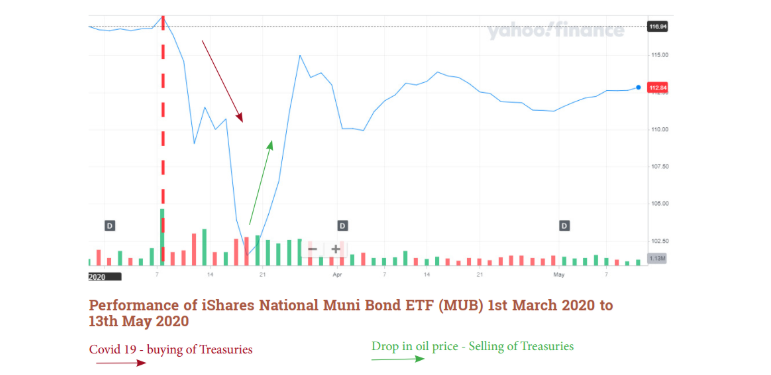

The sharp fall of oil prices due to the Saudi-Russian tit for tat started at the end of February 2020, caused a sell-off of equities and buying of mutual bond funds. This sudden and large volatility impacted the hedgers in the bond futures market who were unable to offer positions to the traders because of price uncertainty. The absence of price visibility negatively impacted the net asset values of the mutual funds which in turn triggered a sell-off and a downward spiral that lasted for two weeks in the middle of March 2020 before a bounce back.

The COVID 19 pandemic meant that equity investors were investing in the safety of bonds, backing the ‘horse’ instead of the ‘hound’ but then soon after when oil prices began to fall there was a sell-off of Treasuries in favor of the short-term money market investments. A total return bond manager could have bought bonds in December 2019 and sold at the end of February 2020 and then bought again a few weeks after 9th March 2020.

9th March 2020

9th March 2020 was the start of historic volatility in the US capital markets caused by the oil standoff between Saudia Arabia and Russia, both countries vying for a larger share of the oil market with the backdrop of COVID 19 and suppressed world oil demand and in the process creating such a massive glut in oil supply that tankers were stuck in the sea unable to offload their cargo of oil. Such a sharp price movement had not been seen since the credit-related crash of Lehman in September 2008 which provoked a sell-off of equities and panic buying of Treasuries depressing yields until they recovered in Q2 of 2009. However, the fall in oil price in March 2020 was liquidity related and created so much volatility in the bond yields that it caused a panic sale.

What is the role of the Fed in supporting the money market?

On 18/3/2020, the Fed established a liquidity facility to support the money market funds (MMF’s) which invest in short term notes typically Revenue and Bond Anticipation notes or RAN’s and BAN’s. The Boston Fed will provide a secured credit facility to the banks to purchase investment-grade notes from the MMF’s to maintain liquidity at a time when these funds are experiencing redemption calls. The US has also established, through the Fed, a Term Assets Backed Securities Loan Facility (TALF). The Treasury is indirectly lending to the market makers to buy and sell investment-grade municipal debt. Again, to inject liquidity in a frigid market and will underwrite any losses of defaulting states. The TALF program avoids the thorny issue of the Treasury behaving as a debt collector. The money will be used to stabilize the long-term markets in investment-grade bonds. The Fed’s balance sheet was standing at $4.2tn at the beginning of March 2020 and it is now $6.7tn, most of the increase relates to the acquisition of mortgage-backed securities guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Does this sound familiar?

What about bond defaults?

We should not expect any defaults on the investment-grade General Obligation bond (GOB) issuances from the larger states in the US such as New York or Washington however, there will be downgrading of credit ratings and thinner debt service coverages in the future. This means that bonds will get cheaper and we saw this, for example, in the price of New York City’s MTA 2034 callable bond where yield rates are slightly above the 5% coupon rates. We will see a lot of interest in such types of bonds with relatively attractive rates and outperforming the MUB ETF. The high-grade bonds are delivering around 3% yields which may be adjusted upwards depending on the economic data and possible downgrading in ratings and deteriorating debt service coverage but still seem cheap when compared to the long bonds which are trading at under half these yields.